Embark on a journey to decipher the intricacies of your pay stub with our comprehensive guide. Understanding your pay stub worksheet answers empowers you with the knowledge to navigate your finances confidently. This exploration delves into the various components of a pay stub, deciphering deductions, unraveling taxes, and ultimately calculating your net pay.

Uncover the secrets of gross pay, unravel the complexities of deductions, master the calculation of taxes, and emerge with a newfound understanding of your paycheck. Prepare to transform your financial literacy and take control of your earnings.

Understanding Your Pay Stub: Understanding Your Pay Stub Worksheet Answers

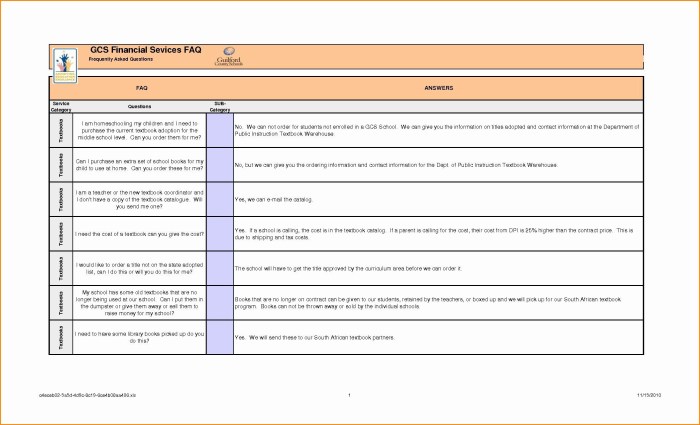

A pay stub is a document provided by employers to employees that details their earnings and deductions for a specific pay period. Understanding your pay stub is crucial for managing your finances effectively and ensuring that you are being compensated fairly.

Components of a Pay Stub, Understanding your pay stub worksheet answers

Typical pay stubs include the following sections:

- Gross pay:Total earnings before deductions and taxes.

- Deductions:Amounts withheld from gross pay for various purposes, such as taxes, health insurance, and retirement contributions.

- Taxes:Amounts withheld from gross pay to cover federal, state, and local taxes.

- Net pay:Amount of pay remaining after deductions and taxes have been taken out.

Common deductions include:

- Federal income tax

- State income tax

- Social Security tax

- Medicare tax

- Health insurance premiums

- Retirement plan contributions

- Union dues

Understanding Gross Pay

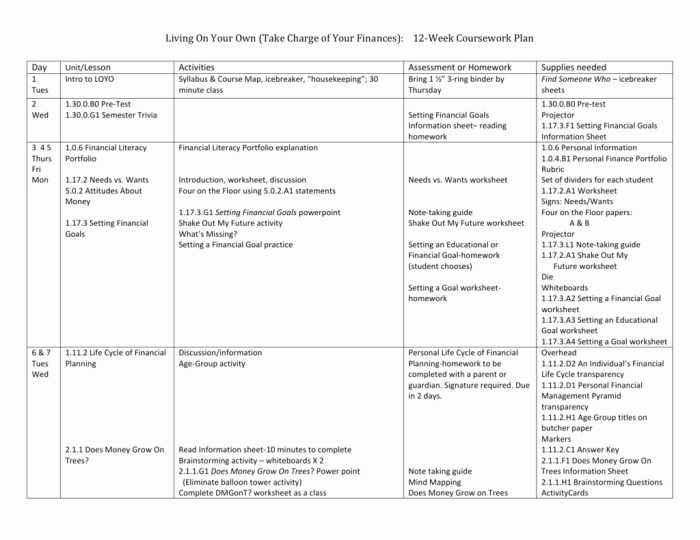

Gross pay is the total amount of earnings before any deductions or taxes are taken out. It is typically calculated by multiplying the employee’s hourly wage by the number of hours worked during the pay period.

Factors that can affect gross pay include:

- Hourly wage

- Overtime hours

- Bonuses

- Commission

Gross pay can be calculated using the following formula:

| Hourly wage | x | Hours worked | = | Gross pay |

|---|

For example, an employee who earns $15 per hour and works 40 hours in a week would have a gross pay of $600 (15 x 40 = 600).

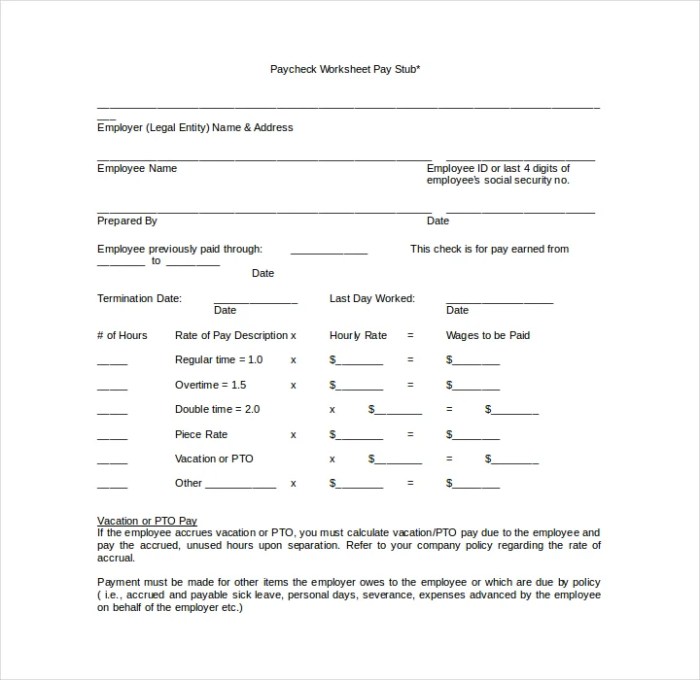

Identifying Deductions

Deductions are amounts withheld from gross pay for various purposes. Deductions can be categorized into the following types:

- Mandatory deductions:Deductions required by law, such as taxes.

- Voluntary deductions:Deductions that are optional, such as health insurance premiums and retirement plan contributions.

Common mandatory deductions include:

- Federal income tax

- State income tax

- Social Security tax

- Medicare tax

Common voluntary deductions include:

- Health insurance premiums

- Retirement plan contributions

- Union dues

- Charity contributions

Deductions can significantly reduce net pay. It is important to carefully consider the deductions that are being taken out of your paycheck and ensure that you understand the implications of each deduction.

Key Questions Answered

What is gross pay?

Gross pay represents your total earnings before any deductions or taxes are applied.

What are common types of deductions?

Deductions can include taxes, health insurance premiums, retirement contributions, and union dues.

How are taxes calculated on my pay stub?

Taxes are calculated based on your income level, filing status, and other factors, and include federal income tax, state income tax, and Social Security tax.